A Portrait of Black Women Entrepreneurs in Canada

I. Introduction

On February 22, 2023, Bassirou Gueye from Statistics Canada published his study, “Black Business Owners in Canada.” The Black Entrepreneurship Knowledge Hub (BEKH) team used the lens of Black women entrepreneurs to outline the most salient facts from the study.

By way of an introduction, as of 2018, there are approximately 66,880 Black business owners in Canada, which accounts for 2.1% of all business owners. The provinces with the highest percentages of Black-owned businesses are Ontario (2.8%), Quebec (2.5%), and Alberta (2.2%) (Gueye, 2023)..

Black women account for approximately three to four percent of the total female working-age population.

II. Facts

Black women entrepreneurs are under-represented

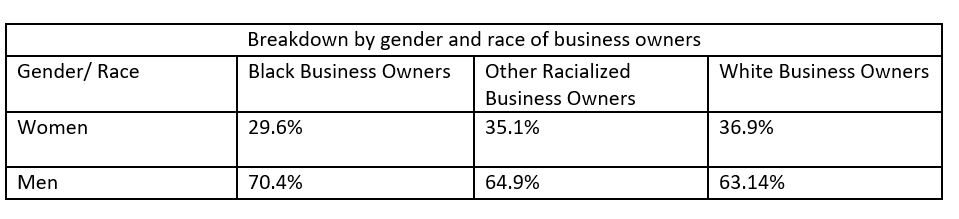

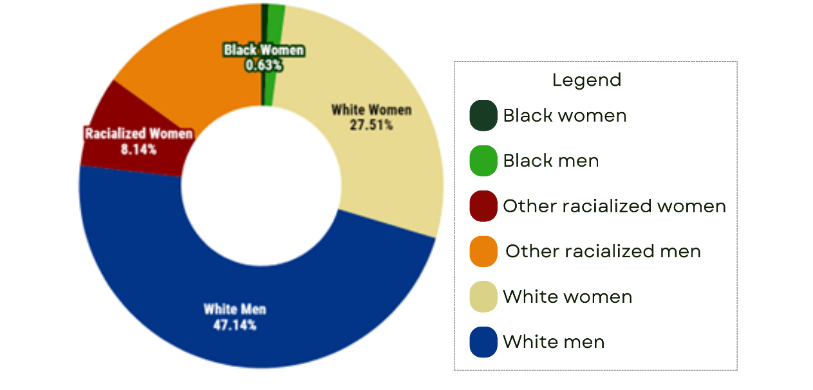

As of 2018, Black women are 29.6% of all Black business owners and 1.7% of all women business owners. In addition, they represent 0.63% of all entrepreneurs across all races in Canada (Gueye, 2023).

The Black population has one of the broadest percentage gaps between male and female business owners.

The gap between Black men and women entrepreneurs is similar to that of Indigenous business owners. Black men account for 70.4% of Black entrepreneurs, and Black women account for 29.6 %. In comparison, on average, Indigenous men held 73.4% of Indigenous-owned businesses (between 2005 and 2018), while women held 23.2% of Indigenous-owned businesses for that same period (Gueye et al., 2022).

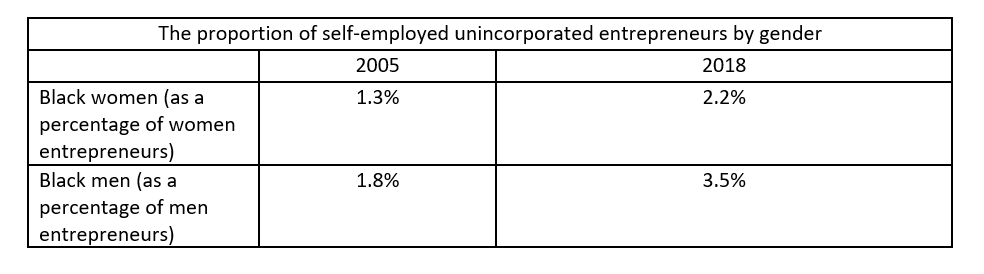

Growth of Black Women Entrepreneurs

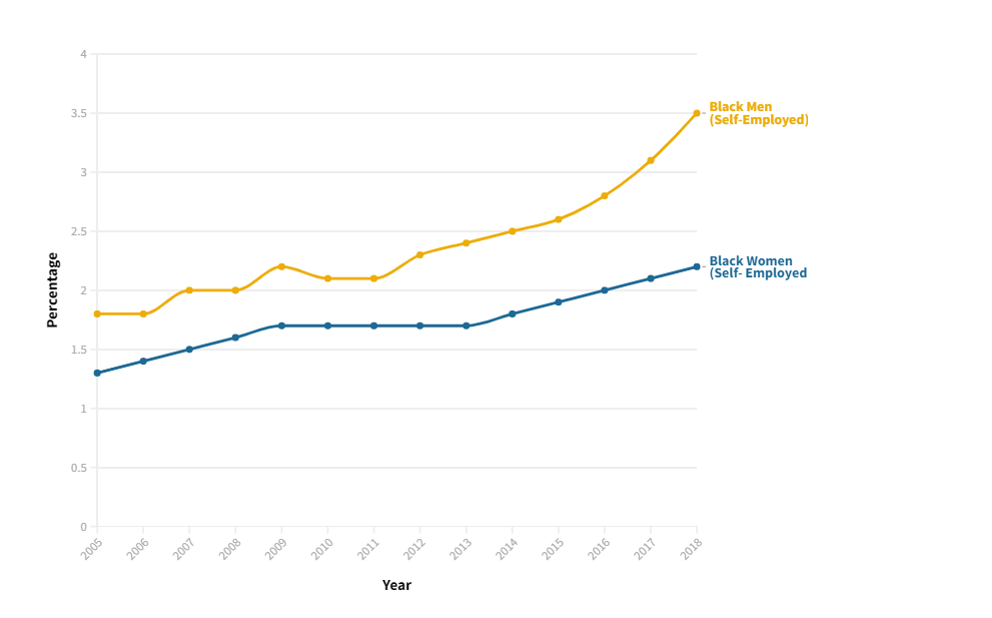

Generally, the percentage of Black entrepreneurs has increased over time; however, for Black women, that percentage has gradually increased by 0.9% in thirteen years. In contrast, the percentage of Black men who are self-employed or owners of an unincorporated business has almost doubled between 2005 and 2018. As of 2018, 3.5% of all self-employed men are Black men.

In that same period, the percentage of all self-employed women owning an unincorporated business also increased significantly. Indeed, the number of all self-employed women with unincorporated businesses increased by 13.2% between 2005 and 2018 (Statistics Canada, 2023). Moreover, the number of women-owned private incorporated businesses increased by 33% in the eight years between 2005 and 2013 (Grekou et al., 2018).

Immigrant Versus Canadian-by-birth Women Entrepreneurs

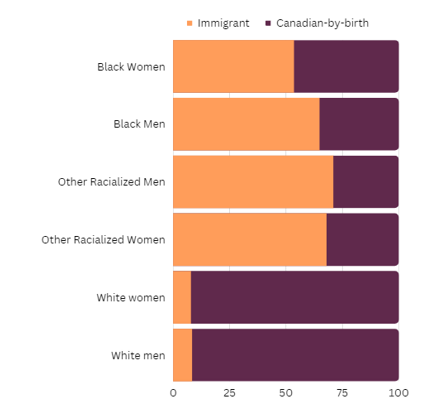

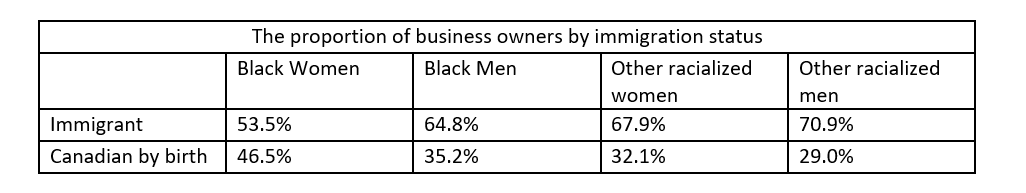

Both immigrant Black women and Canadian-born Black women are actively participating in entrepreneurship. There is almost an equal division of the proportion of Black women business owners that are immigrants and Canadian-born.

Indeed, 53.5% of Black female entrepreneurs are immigrants, and 46.5% of Black women business owners are Canadian-born (Gueye, 2023). Among all racialized groups, Black women business owners are the highest percentage of Canadian-born business owners.

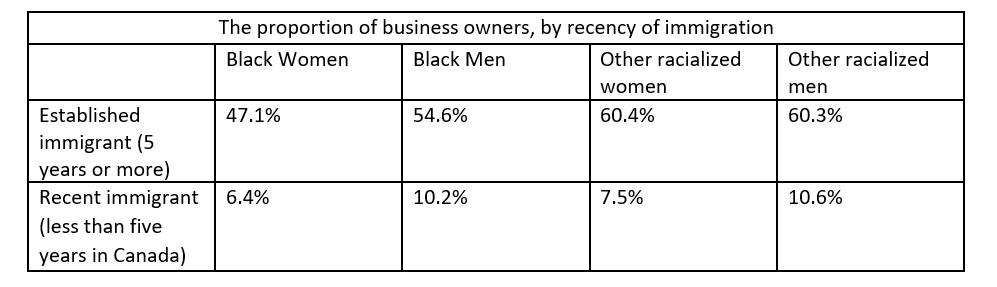

Most immigrant business owners are established in Canada, meaning they immigrated at least five years ago.

Suppose we exclude White people because there are very low percentages of White immigrant business owners. In that case, it is telling that Black women immigrant owners had the lowest percentage of recent immigrant business owners. Further research would be required to understand why there is a slightly higher percentage of recent immigrants business owners amongst racialized groups.

Age

Black women are, on average younger than their White counterparts. For example, the average age for Black women, Black men, and other racialized entrepreneurs (men and women) is 47 years old. Meanwhile, the average age for white men and women entrepreneurs is 53 years old.

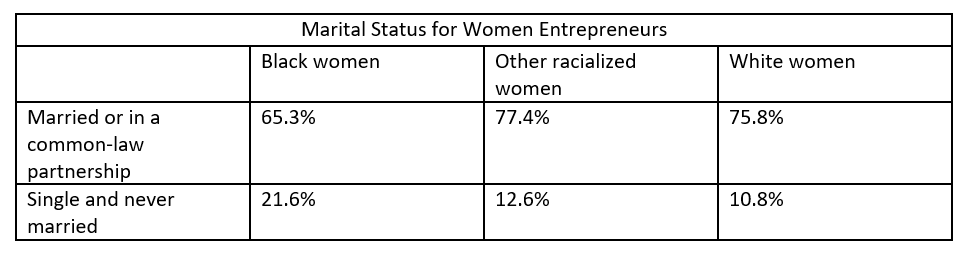

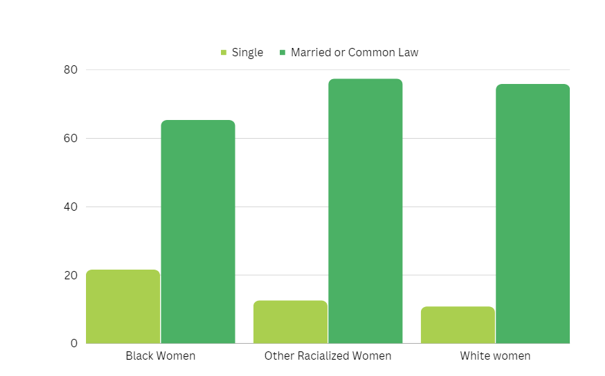

Family composition: Marital Status

Most business owners are married or in a common-law partnership, which is also true for Black women business owners (65.3%). Nevertheless, there is also a higher proportion of single Black women entrepreneurs (21.6%). However, that is not true for other racialized women or white women.

Another aspect of family composition that needs to be considered is motherhood. In the "Foundhers,” a study by Pitchbetter Canada, Black women entrepreneurs who were also mothers described the challenges of balancing the business's needs with their responsibilities towards their family.

Furthermore, one entrepreneur highlighted that resolving tensions in her child's life resulting from systemic racism and discrimination meant that her problems came with an emotional cost that other mompreneurs may not face. (PitchBetter Canada et al., 2021, pp. 54, 57) There is an opportunity to explore the impact of marital status and parenting on the entrepreneurship experiences of Black Women business owners.

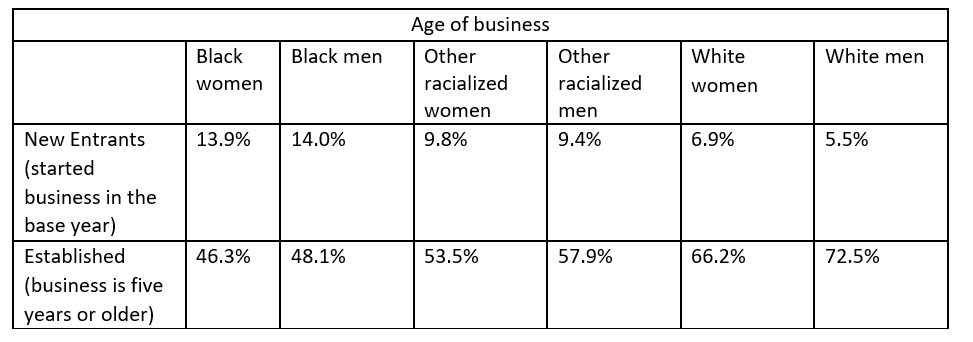

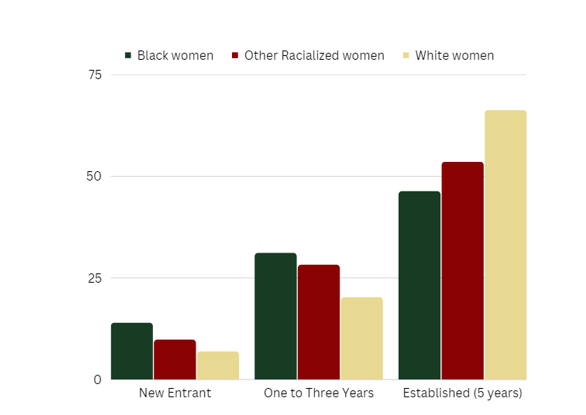

Age of businesses

For the most part, most business owners across all races have established businesses—that is, businesses that were created at least five years before 2018. Almost half of the businesses owned by Black women are established (46.3%) (Gueye, 2023).

While Black women have the lowest percentage of established business owners, it also seems that they are leading in creating new businesses. A higher percentage of Black women are new entrants (13. 9%) (Gueye, 2023). The percentages of Black men and women business owners that are new entrants are similar.

The age of business sparks questions in terms of the viability of a business. Most Black entrepreneurs own unincorporated businesses—Black business owners own 2.9% of all unincorporated businesses compared to 1.6% of all incorporated businesses (Gueye, 2023). As of 2018, 2.2% of unincorporated women-owned businesses are owned by Black women.

Incorporated businesses tend to have better financial outcomes and experience long-term sustainability (Gueye, 2023). The relatively high percentages of Black women business owners that are new entrants means that Black women are actively entering the entrepreneurial market; however, this may also mean that their businesses are vulnerable.

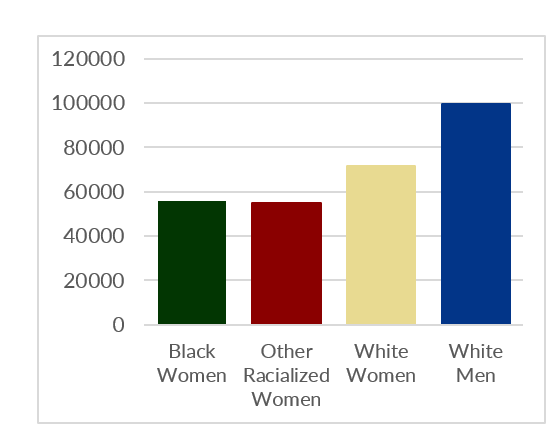

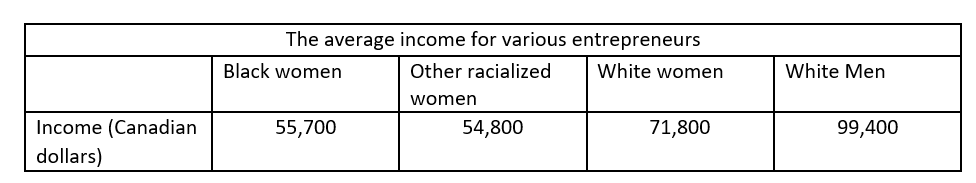

Income (Average)

On average, black women business owners earn $16,000 less than White women entrepreneurs. However, Black women entrepreneurs earn approximately the same as Black men and other racialized women; the difference in average incomes is not statistically significant.

Like most Black entrepreneurs, it is essential to note that Black women tend to bootstrap their businesses. According to a study by the African Senate Group, 82% of all Black entrepreneurs funded their businesses through personal savings, with 25% of entrepreneurs using personal credit cards (Burgesson et al., 2021, p. 30). Meanwhile, a study of over 1,200 Black women entrepreneurs found that 63% had to self-fund up to $100,000 to establish their businesses. Additionally, 43% of the surveyed Black women entrepreneurs could not secure external funding (PitchBetter Canada et al., 2021, p. 50).

Lower average incomes mean Black women cannot easily reinvest in their businesses. As a result, some Black women entrepreneurs have a second full-time job besides their business (PitchBetter Canada et al., 2021, p. 44). During our community consultations, the Black Entrepreneurship Knowledge Hub discovered that if business owner has an additional full-time job to supplement their income, they do not have the time or financial resources to spend on scaling their business.

General information (Industry, Number of employees, and Financial performance)

Finally, to wrap up the presentation of facts on Black women entrepreneurs, let us zoom out and understand the general realities of Black businesses in Canada.

Business size as per the number of employees: Many businesses in Canada are small and medium-sized enterprises, and a majority of businesses across all races would qualify as small enterprises. Black-owned businesses tend to be more absent once we look at the larger businesses. For example, if we compare incorporated businesses with five or more employees: only 8.8% of Black-owned businesses have five or more employees, compared to 17% of White-owned businesses and 12.2% of businesses owned by other racialized groups (Gueye, 2023).

Industry: Most Black businesses are concentrated in the following industries: transportation and warehousing, professional, scientific and technical services, real estate and rental and leasing, and construction. Nevertheless, Gueye emphasizes in his study that Black-owned businesses exist in every industry.

Financial Performance: Black-owned businesses do not perform as strongly as other groups of entrepreneurs. There are disparities in average revenue, profits, and investments. For example, on average, the revenue for a Black-owned business is $460,300 compared to $1.2 million dollars for a White-owned business and $645,300 for a business owned by other racialized groups (Gueye, 2023).

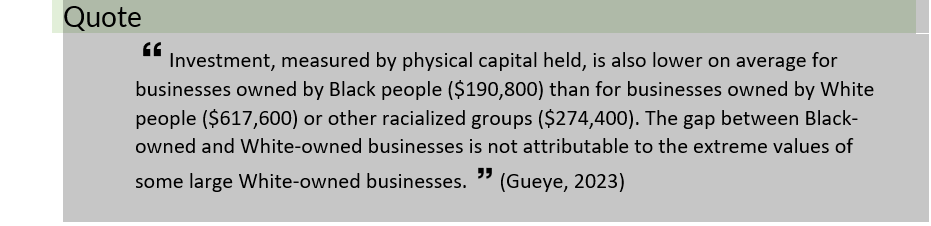

Profitability shows the same issue: the average Black-owned business makes $ 39,000 in profits compared to $180,900 for a White-owned business and $65,200 for a business owned by other racialized groups (Gueye, 2023). The investment into Black-owned businesses was also the lowest compared to White-owned businesses and POC-owned businesses:

III. Analysis – Why does studying Black women entrepreneurs in Canada matter?

Black women are actively creating new businesses – as demonstrated by the fact that a higher percentage of new entrants are Black women than their counterparts. However, one of the most significant impediments to growth is that most Black-owned businesses – including Black women- are self-funded.

As such, there is a cycle of precarity. On average, black women business owners earn lower incomes. They rely on these incomes to self-fund their businesses. Lower incomes mean less money to invest back into the business. Moreover, in some cases, the entrepreneur is then pushed to get a second job. Consequently, they get less time to invest in their business. Their businesses have fewer revenues and lower investments than their counterparts. The final result is that their businesses cannot thrive.

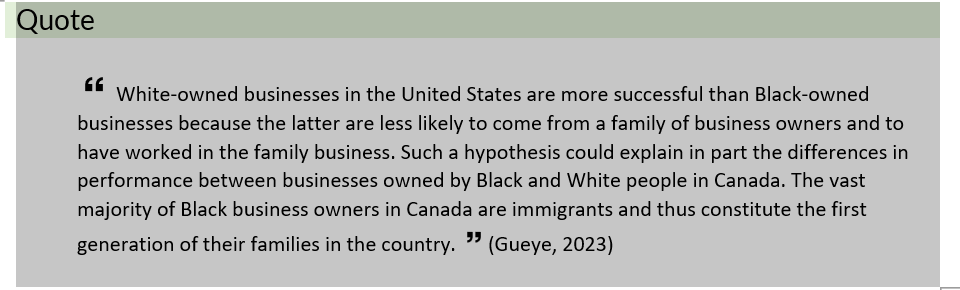

The Black Entrepreneurship Knowledge Hub has found out during our research and community consultations that another driver to the precarity cycle is the difficulty that Black entrepreneurs – including Black women entrepreneurs—have in securing external financing. While the “Black Business Owners in Canada” study explains that some differences may be due to immigration and the consequent differences in generational wealth and credit history:

However, Black women are uniquely positioned because they are the most likely to be Canadian-born, aside from White entrepreneurs. As such, immigration is not a satisfactory enough explanation for disparities between businesses.

Understanding Black women entrepreneurs is critical, considering that Innovation, Science and Economic Development Canada (ISED) calculates that 88.1% of private sector jobs originate from small and medium-sized enterprises (Innovation, Science and Economic Development Canada, 2022). Small business owners are job creators. Black unemployment is higher than the national average (Gueye, 2023), and if adequately supported, Black women entrepreneurs could be drivers in creating jobs for Black communities.

In addition to the loss in potential job creation, the under-representation of Black women as business owners means a loss in contribution to the greater Canadian economy. In 2019, small businesses contributed to 36.7% of the Canadian gross domestic product (GDP) attributable to the private sector. Overall, small and medium-sized enterprises contributed to over 50% of the Canadian GDP (Innovation, Science and Economic Development Canada, 2022).

In a report named "In Pursuit of Equitable Commerce Insights on Black Entrepreneurship in 2023 and Beyond," Shopify shares that according to a McKinsey study, if Black American businesses achieved revenue parity with their non-Black counterparts, there would be an added $190 billion to the American GDP (Shopify, 2023, p. 4).

Black businesses in Canada also operate with a revenue disparity. Achieving revenue parity in Canada could increase the GDP and increase employment in the private sector. The current under-representation of Black women entrepreneurs and limited investment into their businesses means that we are actively leaving money on the table that could instead contribute to growing the Canadian economy.

The loss to the greater Canadian economy is especially noticeable once we factor Black women entrepreneurs’ potential as exporters. Gueye (2023) found that Black immigrant entrepreneurs were motivated to export:

According to ISED, SMEs are powerful contributors to Canada’s general exports: “in 2021, SMEs contributed 42.7% of the total value of exported goods.” (Innovation, Science and Economic Development Canada, 2022).

Another vital reason it matters to study Black women entrepreneurs in Canada is that through the "Black Business Owners in Canada" study and other studies, we uncover significant differences between the realities of Black women entrepreneurs in the United States and Canada. Anecdotally, there is a tendency to downplay systemic racism in Canada and to rely more on data, information and studies conducted in the United States as applicable to Canada. Yet, with the emergence of more research on Black Canadian entrepreneurs, people can observe significant divergences between the two countries.

For example, American and Canadian entrepreneurs face similar challenges in securing external financing and scaling their businesses. However, Black women entrepreneurs are the fastest growing female-entrepreneurial group in the United States:

During a similar period in Canada, Black women-owned businesses did not grow as much; even though, there was an increase in self-employed women entrepreneurs and women business owners with privately incorporated businesses. Therefore, people cannot safely assume that the American reality of Black entrepreneurship is the same as the Canadian context.

IV. Connections to BEKH’s work

BEKH is mandated to lead the following three projects: a large-scale national quantitative study, a large-scale national qualitative study, and a network mapping of the Black entrepreneurial ecosystem. All our work is community-led; in other words, we research with and for Black communities in Canada.

If anything, the “Black Business Owners in Canada” study has underlined the importance of intersectional research on Black entrepreneurs. Without an intersectional lens, Black women entrepreneurs would continue to be overlooked – most Black entrepreneurs are men (70.4%), and most women business owners are white (75.8%). By analyzing Black entrepreneurs in general, researchers could fall into the fallacy of only understanding the problems of Black men and the same with an analysis of women entrepreneurs. There is a real opportunity to grow the numbers of Black women entrepreneurs so that Canada does not experience repeated growth stagnancy as seen in the 2005 to 2018 period.

The ability to bolster, support, and enable Black women entrepreneurs to thrive, starts with rigorous research that understands the current reality of this specific group. In the past, it was harder to research Black women as a part of the Black entrepreneurial ecosystem due to data gaps. For instance, Statistics Canada regularly collects data information on women, indigeneity, and immigrant status. Still, they did not measure race as a variable throughout their many different surveys. As such, researchers could not know if a particular business owner was a Black woman or even a Black immigrant owner – they disappeared into the fold of the broad category.

There is still a great need to research Black entrepreneurship comprehensively. At BEKH, we are leading in research about the Black entrepreneurial community and building capacity within Black communities in Canada to have a sustainable research pipeline.

V. Research Questions

This portrait of Black women entrepreneurs raises the exciting research questions below.

Considering that the divide between Black women entrepreneurs that are Canadian-born and immigrants are almost equal:

· What are the experiences of Black women immigrant entrepreneurs, and how do these experiences differ from Black women entrepreneurs born in Canada?

Considering that there is a higher proportion of single Black women than their counterparts:

· Does family composition impact entrepreneurial experiences for women, and if so, how?

Considering that Black entrepreneurs tend to be the owners of unincorporated businesses, more than incorporated businesses – even though the latter has higher rates of survival:

· What factors and attributes are responsible for the ability of businesses to evolve from unincorporated businesses into incorporated ones?

· How do the experiences in scaling an enterprise differ between Black women-owned enterprises and enterprises from other racial groups?

· What are the motivations for launching an unincorporated business, and what determinants best explain an entrepreneur’s decision to incorporate?

VI. Read more.

Stay connected by reading through the Black Entrepreneurship Knowledge Hub’s other work.

The Portrait of Black Women Entrepreneurs Infographic.

VII. References

References

Burgesson, A., Deacon, C., & Coletto, D. (Eds.). (2021). Inclusive Entrepreneurship : Exploring the barriers facing Black Entrepreneurs in Canada. In Senator Colin Deacon: Projects, Inclusive Entrepreneurship. Retrieved November 4, 2022, from https://colindeacon.ca/projects/inclusive-entrepreneurship/

Grekou, D., Li, J., & Liu, H. (2018, September 24). Women-owned Enterprises in Canada. Statistics Canada. Retrieved March 10, 2023, from https://www150.statcan.gc.ca/n1/pub/11-626-x/11-626-x2018083-eng.htm

Gueye, B. (2023, February 22). Black Business Owners in Canada. Statistics Canada. Retrieved March 6, 2023, from https://www150.statcan.gc.ca/n1/pub/11f0019m/11f0019m2023001-eng.htm

Gueye, B., Lafrance-Cooke, A., & Oyarzun, J. (2022, December 22). Characteristics of Indigenous-owned businesses. Statistics Canada. Retrieved March 29, 2023, from https://www150.statcan.gc.ca/n1/pub/36-28-0001/2022012/article/00004-eng.htm

Innovation, Science and Economic Development Canada. (2022, November 29). Key Small Business Statistics 2022. Retrieved March 30, 2023, from https://ised-isde.canada.ca/site/sme-research-statistics/en/key-small-business-statistics/key-small-business-statistics-2022

PitchBetter Canada, Canadian Women’s Foundation, Business Development Bank of Canada (BDC), & Brock University. (2021). Foundhers: The first and largest market study of Black Women founders in Canada. In FoundHers. Retrieved March 29, 2023, from https://foundhers.ca/

Shopify. (2023, February 1). In Pursuit of Equitable Commerce Insights on Black Entrepreneurship in 2023 and beyond. Retrieved March 29, 2023, from https://news.shopify.com/optimistic-excited-resilient-af-shopify-data-shows-how-far-black-entrepreneurs-have-come-and-the-barriers-they-still-face

Statistics Canada. (2023a). Table 14-10-0027-01 Employment by class of worker, annual (x 1,000) [Dataset; Webpage]. https://doi.org/10.25318/1410002701-eng

Statistics Canada. (2023b, February 22). The Daily — Study: Black Business Owners in Canada. Retrieved March 6, 2023, from https://www150.statcan.gc.ca/n1/daily-quotidien/230222/dq230222a-eng.htm

Ventureneer & American Express. (2019, October). The 2019 state of women-owned businesses report. Ventureneer. Retrieved March 29, 2023, from https://ventureneer.com/wp-content/uploads/2019/10/Final-2019-state-of-women-owned-businesses-report.pdf